07.30

For years, we’ve heard tales of improper behavior involving one of Walker County’s most respected charities. If true, the organization and its leaders are guilty of lying to the public, breaking a trust with the community, abusing government resources, and stealing from children.

And that’s why The Underground made every effort to verify the stories one way or another before posting this piece.

Unfortunately, the elected officials who direct this organization have blocked our efforts to access and examine records that could show them innocent of the claims. Their lack of transparency and delay tactics (along with what evidence we have been able to obtain) make it pretty obvious that something questionable is going on. That puts us in a position where we cannot with a clean conscience remain silent as the election passes by.

Walker County Stocking Full of Love, Inc. is a charity providing Christmas gifts for needy children. SFL was started in 1988 by then-Sheriff Al Millard, and now unofficially bears his name in tribute. In the 24 years since SFL was started, thousands of local kids have gotten toys during the Holiday season, thanks to hard-working volunteers and generous donations from local residents and businesses.

On the outside, Stocking Full of Love is like any other charity or non-profit, accepting community support to help those in need. But SFL differs from most charities and non-profits because it’s not actually recognized as a tax-exempt organization by the IRS. And without that recognition, Stocking Full of Love doesn’t have to verify how funds are spent, and cannot legally claim to be tax-exempt.

IRS registered charities are required to fill out paperwork each year showing donations of money or material and expenses, including salaries and program costs. Those completed forms are available on GuideStar (free registration required) and a number of other sites that list nonprofit organizations. Official nonprofits are also required to provide financial statements to anyone when requested; that’s one way the law keeps charities accountable to the communities that support them.

Here are some examples of filed reports:

Jimmy Simpson Foundation | NWGA United Way | GNTC Foundation

Walker County Stocking Full of Love, Inc. is incorporated in Georgia as a nonprofit, but doesn’t file those reports because it’s never been registered with the IRS as a 501(c)3 or similar type of legal non-profit. This list of all legitimately registered local charities doesn’t include SFL, because it’s not one.

That means that all the money contributed to SFL for purchasing children’s Christmas presents has no accountability. There are no annual reports, no audits, and no outside entities making sure things are handled legitimately. None of this is in dispute, and none of that is by itself illegal or unethical, even though the group has in some years claimed donations in excess of $50,000.

But according to several people inside law enforcement, a portion of unaccountable Stocking money has been used to personally benefit the group’s CEO – Walker County Sheriff Steve Wilson.

During 2009, according to direct witnesses, Stocking Fund treasurer and coordinator Bruce Coker spent several hundred dollars of donated funds to purchase a gift for Wilson. That gift was a pricey shotgun specially designed to be easier for the Sheriff to handle while recovering from cancer treatments. Department insiders say the weapon was purchased from GT Distributors in Rossville, a vendor of firearms and protective equipment for law enforcement and public safety agencies. Mr. Coker reportedly wrote a check for the weapon out of the Stocking account, then presented it to the Sheriff as a gift in front of at least thirteen other people.

Witnesses are said to include Walker Sheriffs Department employees Mike Freeman, Pat Cook, Bob Neighbors, Dewayne Brown, Tim Perkins, Donny Phillips, Greg Dixon, Anthony Gilleland, David Gilleland, and Chris Anderson. Catoosa Sheriff employees Eric Bradshaw, Freddie Roden and Jason Sullivan were also present along with Wilson, Coker, and several others yet to be identified. All, including Wilson, knew how the gift was purchased.

Several of the men present were concerned about Coker using Stocking Full of Love funds for the purchase, and they complained loudly enough that he later reimbursed the SFL account using what was described as “SWAT money.” Witnesses and Walker SO employees were also concerned enough in 2009 to contact us about the shotgun incident and other observed problems. Insiders noted other questionable purchases of dinners, flowers, and additional items possibly for personal use with Stocking money, and several expressed concern about untrackable cash donations.

For the record, 2012 sheriff candidate Roden was the first to tip LU about this incident, and knowing he intended to run for office we decided not to follow up on his report. But after time we began hearing from many others currently and formerly employed by the Sheriff’s Office who had seen or heard of the same incident and wanted something done about it. A tip that wasn’t usable by itself became a matter of interest once employees of the Sheriff’s Office began reporting other abuses and openly referring to the charity as “Stocking Full of Guns.”

For the record, 2012 sheriff candidate Roden was the first to tip LU about this incident, and knowing he intended to run for office we decided not to follow up on his report. But after time we began hearing from many others currently and formerly employed by the Sheriff’s Office who had seen or heard of the same incident and wanted something done about it. A tip that wasn’t usable by itself became a matter of interest once employees of the Sheriff’s Office began reporting other abuses and openly referring to the charity as “Stocking Full of Guns.”

Stories of fraud or theft at a charity are easy enough to check out by simply looking at financial reports – 990 filings, audits, or bank records. But since SFL isn’t under IRS rules most of those records don’t exist, and leaders are under no obligation to show anyone records that do exist. Several attempts on our part to ask Wilson and Coker about SFL or access financial reports were unsuccessful – further raising suspicions of shenanigans.

Since Stocking Full of Love is run inside the Sheriff’s Office, staffed by WCSO employees, and uses the Sheriff’s Office tax ID number, it falls under the state’s Open Records Act. That means financial records (and other documents) can be formally requested with a letter which must be responded to within three days. So in early June an Underground contributor made such a request for all Stocking Full of Love bank statements from January 2009 through April 2012.

Having the statements would have allowed us to quickly see if anything questionable was done with SFL funds, and if no suspicious transactions showed up then the matter would be settled and forgotten. But the records request, processed by the Sheriff’s secretary, was dragged out for weeks instead of taken care of within three days as the law requires. A packet of records was finally mailed out during the last week of June, but contained only the base bank statements without necessary copies of cleared checks.

An additional records request was made during the first week of July, specifically requesting copies of all cleared checks for the same time period – but as this is written on July 30, that request has yet to be filled, again breaking Georgia open records law by taking over four weeks instead of the required three days without explanation.

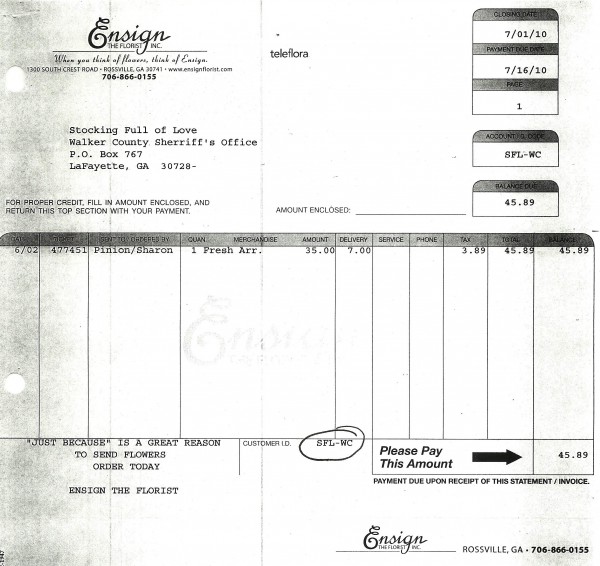

Despite exhaustive efforts, the only Walker County Stocking Full of Love financial record the Underground has obtained is a copied receipt for $45 of flowers ordered from a Rossville florist in July 2010. Flowers aren’t toys, and July is a long way from Christmas, but there may be a legitimate reason for the purchase. Without transparency and access to more records, there’s no way to know what this is, and no way to determine if it fits into a pattern of spending donated cash on personal items.

Stocking Full of Love’s lack of transparency and unwillingness to register with the IRS aren’t necessarily verification of corruption, but they are troubling. If there’s nothing to hide, why are records still withheld after being lawfully requested? Are Coker and Wilson dragging their feet to delay public knowledge of spending activity until after tomorrow’s vote? A tale that could have been quashed in an hour by examining financial records has lingered on for three years unresolved due to their lack of cooperation.

Since SFL isn’t a real charity under IRS rules, it’s not a violation of tax law to use group money for personal benefit. But collecting money for kids and spending a portion of it on something else is unethical to the extreme, and might even be considered fraud or theft by deception in a county where the alleged criminals aren’t the same ones enforcing the law. Anyone personally benefiting from SFL money could also be personally liable for unpaid taxes.

One thing we know for sure is that Stocking Full of Love has claimed on more than one occasion to be tax exempt. It’s not, as noted above, and saying otherwise is against the law.

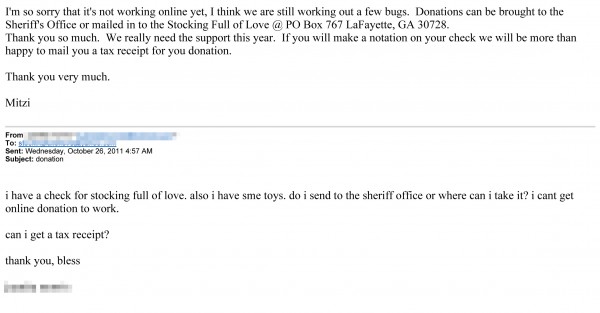

Unfortunately for this lady, any tax receipts issued by Stocking Full of Love aren’t worth the paper they’re printed on, because donations to that organization aren’t tax deductible.

Multiple accounts of abuse, false claims about tax exemption, refusal to share financial records, unexplained flower receipts, and lack of accountability; these cause us to feel very strongly that the stories of impropriety at Stocking Full of Love are at least worthy of discussion, and should be made known to the voters and taxpayers of Walker County.

Steve Wilson and Bruce Coker are CEO and Treasurer/CFO for this organization. They are ultimately responsible for what goes on with the organization and its money. Being a sheriff, a deputy, and a candidate for judge these men should be above reproach morally. But their actions related to this organization raise a lot of questions and a lot of doubts.

Walker County Voters need to ask Coker and Wilson why SFL has existed for a quarter century without seeking IRS nonprofit status. They need to ask why SFL claims to be exempt when it isn’t. They need to question if tax dollars from the Sheriff’s Office budget are being used to run an organization that behaves improperly. They also, most importantly, need to demand that Coker open the group’s financial records for public inspection so everyone can see if the stories about abuse are true or not.

Every year we see news reports and press releases about the great things done through Walker County Stocking Full of Love. There’s no doubt that many children ARE being given gifts by this organization, gifts purchased with donated funds. But there’s no assurance that everything given is being used as intended. If money meant for Stocking Full of Love toys has been spent to buy toys for adult men at the Sheriff’s Office, then the organization’s leaders are guilty of stealing from children and lying to the community.

The response to this piece will no doubt be fierce and negative towards The Underground and our sources. We’ll be slammed for attacking Stocking Full of Love, children, law enforcement, Christmas, and the church where gifts are distributed. But all we’ve done is make you aware of what’s been said, of some obvious problems and some questionable actions. If anyone has attacked the charity and its core purpose, it’s the leaders who have allowed it to be run in an unprofessional way.

If the accounts of abuse are proven true, they’re a slap in the face of everyone who’s ever given a dime to Walker County Stocking Full of Love. They’re also a slap at all the schools, civic clubs, and churches that have conducted fundraisers for SFL over the years. And they’re a slap at the children who would have benefitted from the funds that were mishandled. Slaps from Coker and Wilson, not from us.

We hope and pray Stocking Full of Love continues forward and does more great things than ever before – but to do that, the group should be made accountable for every penny given. We want to see Walker County and beneficial nonprofits move forward, not regress into corruption and abuse due to poor oversight and ethically-challenged leadership.

So glad this is finally out in the open! I have been told one of these men also gives “Stocking full of love” toys out at church sometimes after services, to children who are not in need. Great job, LU!!!

Just another attempted to turn voters against Bruce Coker!

Couple notes and some things that didn’t fit in the report.

Is it normal for customers at Ensign Florist to get a customer number like that? SFL-WC? May be an indicator that they’re a regular customer.

Since Walker Co Stocking Full of Love isn’t recognized by the IRS it doesn’t have a tax ID number, or EIN. When making purchases or doing anything that requires an EIN they use the Sheriff’s Office number, which is a concern – but it definitely makes the org. fall under Open Records Act rules. They cannot legally refuse to share financial records.

There’s a legitimate 501(c)3 charity in Walker County called Empty Stocking Fund. That group has a similar name but is not related to Stocking Full of Guns. Empty Stocking is funded by United Way, DFCS, and the Bank of LaFayette (among others) and its annual 990 reports are available online.

This isn’t an attempt to “smear” Mr. Coker or Mr. Wilson, but an effort to let voters know what they’re voting for. They’ve had PLENTY of opportunity to show the SFL books, to share them with our contributor or post them online somewhere. They’ve also had 24 years to fill out the IRS paperwork that would certify SFL as a legitimate charity but have failed to do so. I’m sorry if this looks bad being posted so close to the election but it would have been taken care of and dismissed long ago if they were willing to show the records with no questionable transactions.

As soon as we have any additional records (and the second request IS still pending) we will do a follow-up article.

Also, big thanks to the contributor who stuck their neck out on this by putting their name on the two record requests. That person’s identity is known now to WCSO and that puts them in danger of harassment, or worse. If the community doesn’t respond to this piece, it just puts them more at risk.

— LU

Why is it that any time Coker is accused of something his supporters never, and I do mean never, say that it isn’t true? All they do is say what a good man he is(which is debatable) and how they like him. From the Sam Parker fiasco to him being only minimally qualified to run for Magistrate to the Stocking Full of Guns business(which has been known about and discussed in the WSCO for a long time) to him just wanting to be elected to any office under the sun that he thinks he can win. His supporters simply ignore these things when presented and say he’s a good man. They don’t address the questions. They just try to change the subject.

Just a “note” …. After Phillip Street ( Dade Co. Sheriff 22 years ) was voted out of office, Steve Wilson gave him a position. Mr. Street stayed in that position until he found something better….a Job at GT Distributors….

Adam: also see Good Christian Man™

http://www.cityoflafayettega.com/glossary/good-christian-man/

— LU

Adam: Maybe these supporters that can’t say anything other than “he’s a good man”, are enjoying some of the perks that come along with there good buddy coordinating the stocking full of guns. It may not be in there best interest to bite the hand that feeds them, so to speak. From what I understand, he has been offering everybody and their brother a job in his office, when (not if) he gets elected.

Non Profit organizations whether it be Stocking Full of Love, Jerry Lewis Labor Day Telethon, etc are in fact extempt from an “income tax” as far as NOT having to pay taxes on items and/or money earned for the organization. The ONLY tax that is required to be filed is that on any employment wage payment…..but NOT the actual earnings from the organization that goes to the cause of the organization itself….IRS code 501(c)(3). The ONLY illegal activity IF it can be proven that money from this organization was used for other than what the organization represents is using funds under false pretense….but the IRS can’t necessarily get involved in that….. You guys didn’t do sufficient research before posting this…it was a nice attempt though, just a failure as always….oh by the way I have a quick question…does the Fulton County District Attorney’s office know that The LaFayette Underground is using their IP number to disguise that of their own so it’s more difficult to find out whom the lafayette underground is and where it’s coming from ? http://www.cityoflafayettega.com [74.119.146.200] . Perhaps the Fulton County District Attorney’s office would like to be made aware of this? I’m sure that those at the LaFayette Underground will find that the Fulton County District Attorney’s office has resources to find out whom you guys really are and prosecute you guys for illegally masking your own IP number with that of another source…..

From wiki:

United States

For a United States analysis of this issue, see 501(c) and Charitable organization (United States).

After a recognized type of legal entity has been formed at the state level, it is customary for the nonprofit organization to seek tax exempt status with respect to its income tax obligations. That is done typically by applying to the Internal Revenue Service (IRS), although statutory exemptions exist for limited types of nonprofit organizations. The IRS, after reviewing the application to ensure the organization meets the conditions to be recognized as a tax exempt organization (such as the purpose, limitations on spending, and internal safeguards for a charity), may issue an authorization letter to the nonprofit granting it tax exempt status for income tax payment, filing, and deductibility purposes. The exemption does not apply to other Federal taxes such as employment taxes. Additionally, a tax-exempt organization must pay federal tax on income that is unrelated to their exempt purpose.[23] Failure to maintain operations in conformity to the laws may result in an organization losing its tax exempt status.

Individual states and localities offer nonprofits exemptions from other taxes such as sales tax or property tax. Federal tax-exempt status does not guarantee exemption from state and local taxes, and vice versa. These exemptions generally have separate application processes and their requirements may differ from the IRS requirements. Furthermore, even a tax exempt organization may be required to file annual financial reports (IRS Form 990) at the state and federal level. A tax exempt organization’s 990 forms are required to be made available for public scrutiny.

EpicFailure: PLEASE re-read this carefully, especially: A tax exempt organization’s 990 forms are required to be made available for public scrutiny.

This is a good piece. This is the kind of hard hitting stuff that the local media should be doing. No slander here, just LU shining a little light in the dark corners and we get to watch the little critters scurry for cover.

Watch the reaction here: If the subject(s) of the article attack the messenger, then the article is essentially true. If they produce the refutation in a timely manner and with a thorough disclosure, then, the LU is barking up the wrong tree.

Notice they didn’t lie about using a fake IP address by using an IP mask; it’s cool though the Fulton County District Attorney’s office has been e-mailed screen shots of the tracert cmd screen. Soon everyone will know that the LaFayette Underground is and all of their henchmen. I’ll go ahead and spill the beans ; Sherman Gibbs is the LaFayette Underground. Several of his former students is his “contributos”. “Squirmin Sherman” got majorly pissed when he was forced to resign from LaFayette High School for allegedly having inappropriate contact with a male student. He’s been pissed ever since although he agreed to resign in lieu of being arrested and publically charged with a sex crime and agreed not to accept severence pay as well. That’s what you get for tickling little boys there Squirmin Sherman !!

Besides being unethical and possibly illegal to run a charity this way, the money blown on guns or whatever is money taken from needy children. Mr. Coker is the epitome of the “Good Christian Man” (TM!:) and happily struts up and down the church isle every week, just as saintly as you please. Guess politics (and a nice little slush fund) trumps morality in Walker County. Again. Keep at ’em LU!

oh wow of course—- they all corrupt smh walker countys finest — and Nobody is ever held responsible for their actions in this “good ole boy city”… the court system is trying to give minor crimes and weed possesion all this jail time and 10 years paper… while all this is going on behind the scenes and its illegal and not even looked at …swept under the rug… and city employees going around talking about a vacation they are going on with the citys money and a city issued vehicle smh Great Job ** applause** the courts the city employees the district attorneys office and not to mention the whole drug task force needs to all be fired and start fresh… In this town its all about who ya know not what you know…. You got some money to “pay off” shit then your in …… Lafayette is a damn joke

I am pretty sure that bebeheiskellwalkercounty is Harold Waycasie….same MO. Good try Harry.

Whoever it is is the same person (or using the same computer) as EpicFailureAgain. And they’re both similarly ridiculous.

— LU

Walker County Stocking Full of Love, Inc. is incorporated in Georgia as a nonprofit, but doesn’t file those reports because it’s never been registered with the IRS as a 501(c)3 or similar type of legal non-profit. This list of all legitimately registered local charities doesn’t include SFL, because it’s not one.

You can also call the IRS to find out if an organization is qualified. Call 1-877-829-5500

irs publication 526

Types of Qualified Organizations

5. The United States or any state, the District of Columbia, a U.S. possession (including Puerto Rico), a political subdivision of a state or U.S. possession, or an Indian tribal government or any of its subdivisions that perform substantial government functions.

Note. To be deductible, your contribution to this type of organization must be made solely for public purposes.

Example 1. You contribute cash to your city’s police department to be used as a reward for information about a crime. The city police department is a qualified organization, and your contribution is for a public purpose. You can deduct your contribution.

So if you donate $5,000 to your sheriff’s office to provide toys for needy children for christmas, then the donation is for a public purpose, even if you have children that may benefit from the program.

As you state in the article the SFL uses the Sheriff’s Office EIN number and does qualify for tax deduction for the purpose of giving toys to children under the irs rules. Operating under the Sheriff’s Office EIN they are not required to file 990 forms.

Every organization exempt from federal income tax under Internal Revenue Code section 501(a) must file an annual information return except:

11. A governmental unit or an affiliate of a governmental unit that meets the requirements of Revenue Procedure 95-48, 1995-2 C.B. 418

Here’s a link to Procedure 95-48

http://www.irs.gov/pub/irs-tege/eotopich04.pdf

This should remove any question about the SFL being a charitable tax exempt organization. This is research you should have done prior to rushing to put together this story. As a so called community activist you should immediately contact an accountant who specializes in charities or the IRS. Upon receiving this information yourself you should remove any mention of the SFL from this article outside of the two main parties involved.

No I’m not affiliated with the Walker County SFL. If you search guidestar you will see that very few of Georgia Sheriff’s Office charities, similar to this, are set up as 501c3’s. This is because they are set up in a similar fashion.

Here to help: If your comment is true and the reports are true, then they didn’t just steal from a charity, they stole from the government. And the files must still be disclosed under Open Records laws.

— LU

So this makes it acceptable for others to donate and not get into any trouble with the IRS when they claim it on their taxes. So SFL is good, people can donate to it and be free of worry as far as the IRS goes…however that doesn’t clear those who use the funds not for a public purpose, such as buying flowers or a gun for the Sheriff as a personal gift, and various other things that have been mentioned in passing…

So that basically leaves Wilson and Coker under scrutiny for misusing the funds…using funds that others have donated with tax deduction qualifications because it is to used for the good of public for other purposes…

So predictable… Get a little scared, start flinging vitriol and threats. Looks like someone’s fight or flight response has been activated. Run away, little troll!

The link you posted also indicates that these government associated semi-charities must also have certain elements of financial accountability. Are SFL funds accounted for in the WCSO budget, and do financial audits of the county examine SFL books? If not they they cannot be excluded from the rules you say they’re excluded from.

A politician can’t just set up their own charity, say it’s exempt from all laws regulating charities, and then also not follow the laws set up for government agencies. Either they’re breaking rules about non-profits, or they’re breaking the rules about government entities – which form of corruption is better?

— LU

Doesn’t make it a theft until you know the facts of the circumstances. This just makes the situation somethin you don’t like on face value. You are correct about open records. The point is not if my previous comment is true but the fact that you should research every aspect of the story before running it. In this story you have potentially hurt 700 needy Walker County children to further a personal vendetta. I believe 700 is the number of children they provided toys. You should have run two stories if you wanted to get one out before the election. This story isn’t news, it’s blogger gossip. Knowing the laws, after reading it, I can tell that you did not research any part of the non profit status prior to making this public. The potential loss here could be very detrimental to the charity and there is no way to make amends now. Especially the way you have pounded your chest all day with this juicy story that is merely gossip at this point.

here to help….. why havent the records been made public then ?? 3 days ?? its been way over that– just enough time to make fradulant forms for a cover up if you ask me… and i have no idea who runs this website or do i care… it shouldnt matter –lots of people know how this town works, so why would this person want to reveal their identity? to be bad mouthed in public? get real people — i know tons of older men who have kids who have been arrested for crimes, when it comes down to it , the dad knows one of the dtf officers makes a call ” why did you arrest my boy” o my hmmm now they all the sudden are out of the charge GET the HE** out of here if that is not corrupt people then what possibly could be?? friends i know with 2 and 3 duis have just had their grandpas who know the judges “to pay themoff” Open yalls eyes geesh ** Whoever this man is running the LU is just speaking some real ish– some stuff cowards are afraid to make public… I am happy someone is hanging it out to dry :)

Gina: There is alot of corruption in Walker County. However, there is no corruption going on in the state court, probate court or magistrate court, the judges in all 3 of those courts are very fair, genuine people. That being said, if those 3 incumbents are not voted back in today, there will be a ton of corruption going on.

So being a Sheriff’s Office charity, if legally defined as such, any money should be accountable and listed in the Sheriff’s budget.

If you need further proof of how honest Bruce Coler is with charity funds, talk to a former member of the now defunct Optimist Club. The money left in the coffers was to be donated to the JROTC. A donation was made to JROTC but as a personal donation from Mr. Coker.

Good journalism is based on good sources, facts, and research. One of the things you stated in the article is grossly inaccurate. The biggest problem is that its one of the easiest things to research. A simple Google search would have given you the correct information. To me, this makes me wonder how accurate the rest of the story is. If you are going to “mail it in” in regards to something simple, why should we think that you didn’t do that on some of the “juicy” stuff?

The point is this, GT Distributors is in Rossville, not Fort Oglethorpe. Here is the link: http://www.gtdist.com/GTROSSVILLESHOWROOM.htm

A simple Google search would have cleared this up. To further confirm, you could have placed a phone call to their published number. You could have even looked it up in the phone book.

I guess this is what happens when someone thinks that because they have a website, they are a member of the media

Duk: By the time you posted your comment the mistake had been corrected for over an hour. We knew GT Distributors was in Rossville but fingers said Fort Oglethorpe.

Still waiting on somebody to roll out a defense of this based on something besides spelling errors, typos, mistakes on the Open Records request, or comments about IRS laws none of the commenters understand. Bruce Coker took money meant to buy Christmas for kids and illegally purchased a present for his friend. The Sheriff’s daughter has admitted it on facebook but says it’s OK because they eventually paid it back. But the law says it’s illegal. Where’s your defense for THAT?

— LU

July 31st, 2012

I read the article about the Stocking Full of Love, and I must say I was shocked by the Journalistic statements made, such as,

“For years we’ve heard TALES on improper behavior”

What tales?

“MULTIPLE accounts of ABUSE”

What and how many?

“EVIDENCE we have”

What evidence, none stated?

and the list can go on and on. My point is, they have made a lot of accusations, but present nothing to back it up, only what someone thinks they know. If they had questions about what and how the Stocking Full of love does business all they had to do was to call and ask, but no, they get some guy in Michigan to write a letter requesting copies of statements. I thought the LaFayette Underground was a LaFayette, Georgia based organization. He requested the information from the Sheriff, who is not the keeper of the records for the Stocking Full of Love, the treasurer is. The Sheriff can not sign checks, make deposits, or endorse checks to the Stocking Full of Love, he can not do anything with the account, because his name is not on it.

So, as a member of the Stocking Full of Love and former treasurer and events coordinator , I am requesting under the “Open Records Act” information about who has been accusing the Stocking full of Love, and what evidence they say they have. After 39 years in Law Enforcement I know that what someone says they think they know is not evidence. Anyone has the right to know who is accusing them and what evidence they have. I for one, and I’m sure I speak for many members of the Stocking Full of Love, would be ready to meet with the LaFayette Underground, above ground, and answer any questions they might have.

George R. Deer

The tales are described in the article, you should read it.

Multiple accounts. The gun Coker bought. Purchases of flowers and meals for various people. Gifts being given to children of friends not during the holidays.

The evidence is thin, because our Open Records request has been ignored, in violation of state law. We have a flower receipt and a handful of statements from people who saw the violations take place.

The first records request was made to Mr. Coker, the second was made to Ms. Brown, the Sheriff’s Secretary who actually processes the requests.

We’ve e-mailed the Sheriff, we e-mailed the SFL account, and we got no answers. We sent someone out to talk to Coker over a year ago and he didn’t cooperate. We made a lawful request to access the records and it was delayed beyond the scope of the law.

Maybe you should go talk to Mr. Coker about what he’s done with your program since you retired before you come in here and challenge us about reporting on it.

— LU

“IRS laws none of the commenters understand.”

I tried to explain the tax laws in as simple of terms that I could. You can’t blame me it’s too difficult for you to understand. I even suggested you contact someone and gave you the IRS phone number which I know you have not called.

Let us try this again. If the SFL uses the Sheriff’s EIN then each donation is essentially donated to the sheriffs office for tax purposes. The Sheriff’s Office under the tax rules can set up an affiliate which here would be the SFL. Under this setup which is allowed by law the SFL does not have to report the 990 as you stated. In order to get records from the SFL you have to send a request to the keeper of records. Remember as stated before this was all set up by someone other than the current Sheriff.

No tax law violation: CHECK

According to Mr. Deere the SFL is set up as a control board who decide on the day to day operations, which include purchases. Under these rules the money is kept seperate from the Sheriff’s budget. So with that said, in order for the open records request to be valid it has to be sent to the keeper of records for the SFL. Mr. Deere said that is not the Sheriff or the Sheriff’s Office. No records violation has occured here if the records were not requested from the right entity.

No open records violation: CHECK

“stealing from children” That is a harsh thing to throw out with no evidence. Remember in Georgia that theft is “Taking or appropriating the property of another with the intention of depriving the owner of the property.” Also in Georgia it is not just the taking of property, the key words in the law are intention of depriving. So you can’t merely show that money was used from SFL to purchase this item. You must also show for prosecution of a crime that there was intent by someone involved that they intended to deprive the charity of money, You don’t have the records yet but I’m going to go out on a limb and say that you will not be able to show any intent to deprive.

No theft: CHECK

So lets recap: SFL is a ligitamate charity that can provide donors with a tax write off. SFL is a seperate entity that was not served with a valid open records request. No intent to deprive the charity of money so no theft.

What we have here is desperate people grasping at straws, no matter how thin. In order to get a true explaination someone is going to have to act like a true journalist and physically talk with someone involved with SFL or the Sheriff. This is why no legitamate media outlet reports on gossip. Your local tv and newspaper investigates and gets enough facts to substantiate an allegation before throwing out allegations on rumor. If you want to be taken serious as a media source please adhere to some publishing principles. Here are a few articles that may help you improve your work and not be associated with the Star Magazine.

http://publishing2.com/2007/03/31/why-journalism-matters/

http://en.wikipedia.org/wiki/Blogger's_Code_of_Conduct

http://blogs.vancouversun.com/2012/07/06/were-all-journalists-now-some-claim-but-its-not-really-true/

“IRS laws none of the commenters understand.”

I tried to explain the tax laws in as simple of terms that I could. You can’t blame me it’s too difficult for you to understand. I even suggested you contact someone and gave you the IRS phone number which I know you have not called.

Let us try this again. If the SFL uses the Sheriff’s EIN then each donation is essentially donated to the sheriffs office for tax purposes. The Sheriff’s Office under the tax rules can set up an affiliate which here would be the SFL. Under this setup which is allowed by law the SFL does not have to report the 990 as you stated. In order to get records from the SFL you have to send a request to the keeper of records. Remember as stated before this was all set up by someone other than the current Sheriff.

No tax law violation: CHECK

According to Mr. Deere the SFL is set up as a control board who decide on the day to day operations, which include purchases. Under these rules the money is kept seperate from the Sheriff’s budget. So with that said, in order for the open records request to be valid it has to be sent to the keeper of records for the SFL. Mr. Deere said that is not the Sheriff or the Sheriff’s Office. No records violation has occured here if the records were not requested from the right entity.

No open records violation: CHECK

“stealing from children” That is a harsh thing to throw out with no evidence. Remember in Georgia that theft is “Taking or appropriating the property of another with the intention of depriving the owner of the property.” Also in Georgia it is not just the taking of property, the key words in the law are intention of depriving. So you can’t merely show that money was used from SFL to purchase this item. You must also show for prosecution of a crime that there was intent by someone involved that they intended to deprive the charity of money, You don’t have the records yet but I’m going to go out on a limb and say that you will not be able to show any intent to deprive.

No theft: CHECK

So lets recap: SFL is a ligitamate charity that can provide donors with a tax write off. SFL is a seperate entity that was not served with a valid open records request. No intent to deprive the charity of money so no theft.

What we have here is desperate people grasping at straws, no matter how thin. In order to get a true explaination someone is going to have to act like a true journalist and physically talk with someone involved with SFL or the Sheriff. This is why no legitamate media outlet reports on gossip. Your local tv and newspaper investigates and gets enough facts to substantiate an allegation before throwing out allegations on rumor. If you want to be taken serious as a media source please adhere to some publishing principles. Here are a few articles that may help you improve your work and not be associated with the Star Magazine.

http://publishing2.com/2007/03/31/why-journalism-matters/

http://en.wikipedia.org/wiki/Blogger's_Code_of_Conduct

http://blogs.vancouversun.com/2012/07/06/were-all-journalists-now-some-claim-but-its-not-really-true/

I have a question I know you will not answer. What does this say about Mr. Roden’s ethics. He observed something he evidently felt was wrong and possibly illegal. Why didn’t he report this to the proper authorities?

O.K. So if nothing that has been done was “wrong” why not just show the paperwork?

Why provide anything to a site that has no legitamacy? They shouldn’t provide anything to someone who hides behind a proxy and a pseudonym. The open records act requires that a PERSON request the records. I’m sure if someone approached the right people they could have viewed the records. In this case I don’t blame them. They have been attacked on multiple occasions by this group of people who bank on nothing but IF’S and conspiracies. I provided them with the IRS phone number to talk with someone about the legitamacy of the non profit but they have failed to do so. LU please provide us with the name of the IRS agent and phone extension who tells you that this setup is illegal. Otherwise remove the references to SFL. I believe that this is nothing more than a smear campaing by KM, you know who I’m talking about, because he was outed as the LU when he was with K4C. Just like that incident this one should have nothing to do with providing for kids. Simple research by him would justify the charity.

A “person” with a real name and address and pulse and everything did file the request. That person is now being harassed by Mr. Coker in retaliation for his lost election. That’s why we had somebody out of state do it.

Doesn’t matter what the reason is for the request, it has to be filled within the legally required time period. That hasn’t been done, they’ve had over a month.. Because they’re scared of what people will find in the records.

When you’ve seen the SFL bank statements from 2009 to present, then come back and defend Coker and Wilson with what you find.

— LU

Has Mr. Coker forgotten that he has lost more than one election? Eventually, most people get tired of being rejected and give up. Seems as if he is still in the denial stage of loss and trying to blame everyone else for once again not being able to pull off a victory.

Coker is not a good politician, and will never be elected to public office. It’s amusing to watch, as he tries and tries to find him a sit-down gravy job with retirement … only to be rejected time & time again.

If he had a real passion for one particular elected position, and pursued it with the right attitude, then he would eventually succeed. This bouncing from one thing to another is a sure formula for failure.

Maybe Sunrae Water Bottling Co needs a CEO, or CBC (Chief Bottle Capper), and will give Coker a job?

Lyla…..I know who you are

I’m very happy for you!

It seems as more time passes, the information within this article is more true than false. The reason for my assertion is one simple fact. Instead of clearing up the questions, the individual concerned is making veiled threats “Lyla….I know who you are.” and posting personal information and slandering an individual on FB for asking for the information. This kind of thing is called muddy the waters by destroying a person’s reputation instead of doing my job – one of the hallmarks of a guilty person. And the people behind this are supposed to uphold the laws. One has to wonder if this lack of integrity extends beyond this one instance?

Come on down to the Sheriff’s office Monday morning and we will talk about this like adults. Theres no need for me to proceed futher if you will do that….that is if this is you Kristopher.

One of the hallmarks of a coward is when he won’t take accountability for things he says and does. Come out of hiding and meet us as a group of people. We don’t have nothing to hide. I am examining your activities with the Kids4Christ effort. There are some questions I have for you.

Kristopher would have to go an awful long way to get to the Walker Sheriff Dept office, 880 plus miles. Remember when you put up his address on your facebook timeline? Go to google maps, put in Lake Ann, and then LaFayette. Are you conducting official sheriff dept work Bruce? Does the Sheriff support your actions while on the clock. And pray tell, what does Kids 4 Christ have to do with any of this?

Oh and Open Records Requests don’t apply to private charities, private individuals, etc. So you can’t do an Open Records Request on a blogger, or a website, or a ministry.

Bruce: any questions for LU can be asked here, or in e-mail. lu@cityoflafayettega.com .

You seem to be avoiding asking your questions in public about as much as you’ve avoided answering ours.

Hope you have a pleasant weekend.

— LU

I have been patient and I have tried to be nice. If you do do cooperate, then you and those around you will suffer along with you, is that what you want? By the way there were many who saw you in town last week Kris. Was you just here to do your good deeds for the election? I suggest you hop a red eye flight today. Remember , I didn’t start this mess, you did. You might better do what is right.

That was supposed to have been do not instead of do do.

How does Sheriff Wilson feel about one of his officers threatening people? Oh yeah, he’s probably OK with it.. But how would the GBI, or someone from POST, or maybe someone from the real (non-local) media feel about it?

Maybe we’ll find out soon enough.

–LU

Bruce, if you want to address Kris, why don’t you email him? You have his email address. Quit making vague threats against him on the LU website. What exactly are you demanding that he do or not do? FYI – Kris has family in LaFayette. He has the right to visit them when he so cares to do so. He already left town. Stop dancing around the mulberry bush – since you feel free to make threats and accusations on here – why don’t you just lay it out what you are looking for…tell everyone that you are trying to bring down Kids 4 Christ, because LU questioned the financial accountability of Stocking Full of Love. And then explain to everyone why you believe that is okay to do that. Explain your purpose in doing so. Explain why you can’t just put the financial records of SFL out in public so that LU has no grounds to stand on. Explain why your only tactic now is to try to ruin a children’s ministry that has been around for over 10 years and serves children all year round, feeds them all year round, helps their families, gives academic assistance – just because you got your feelings hurt. Explain why the CEO of Stocking Full of Love has nothing to say about this, and why he is allowing you to threaten and bully a private citizen and a non-profit ministry that he is on the board of just because you want to find something to try to bully him with. Explain what you’ve been patient about, because so far I don’t think we’ve seen any patience involved. Explain what your ultimatum is. We’d all love to hear these answers.

Mr. Coker, you should be fired. You make all WCSO and Steve look bad.

when you turn on the lights the roaches and rats will run.

There is a lot of rotten deeds going on in walker county that the law don’t won’t published.